Expense reporting in a few clicks. Divvy helps you control spend while saving time, so what used to take weeks (and lots of email chains) gets done in seconds.

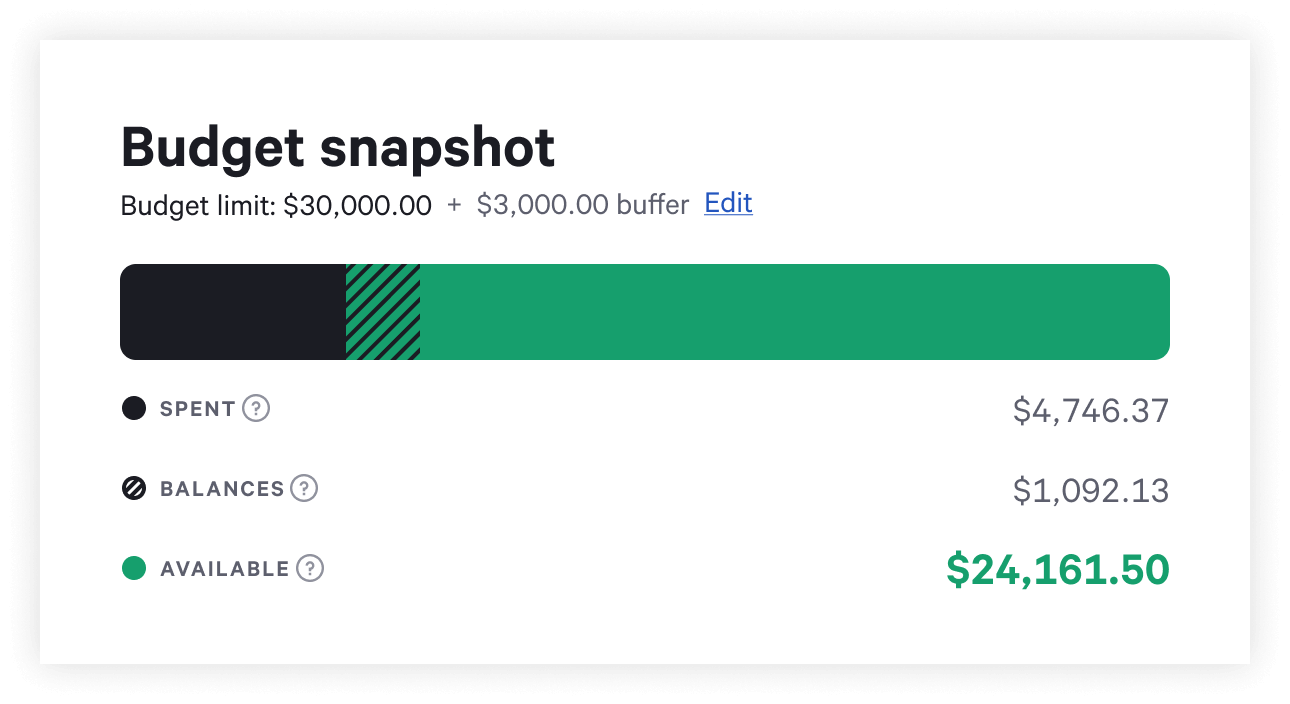

Get rid of the “spend now, ask forgiveness later” mentality with a credit line you can control. Divvy makes it impossible for anyone to overspend and lets you adjust spender funds as needed.

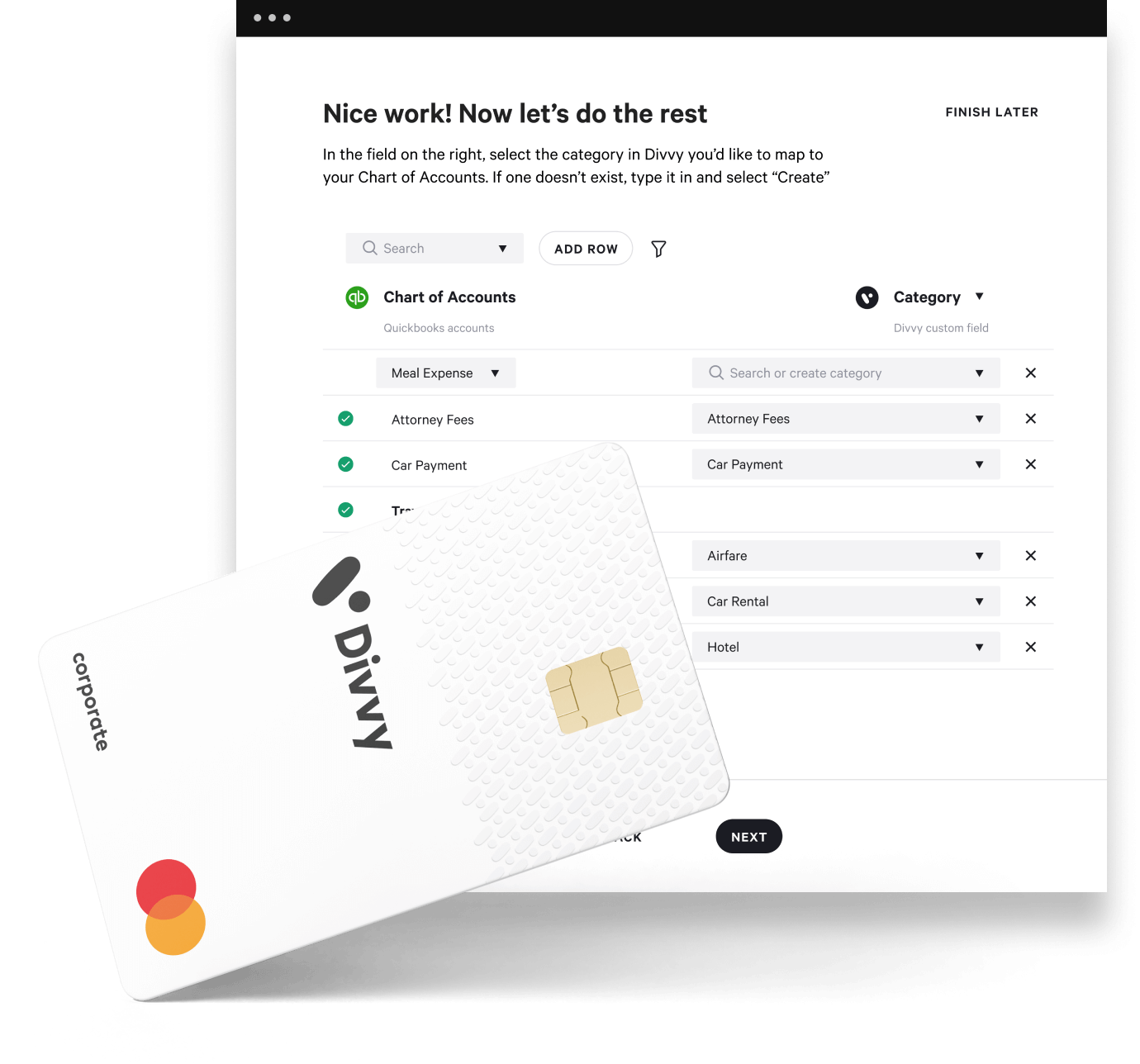

Stop wasting hours each month reconciling credit card statements with your expense management system. After a spender swipes, it just takes a few taps for an expense to be fully coded and ready to upload into your accounting system.

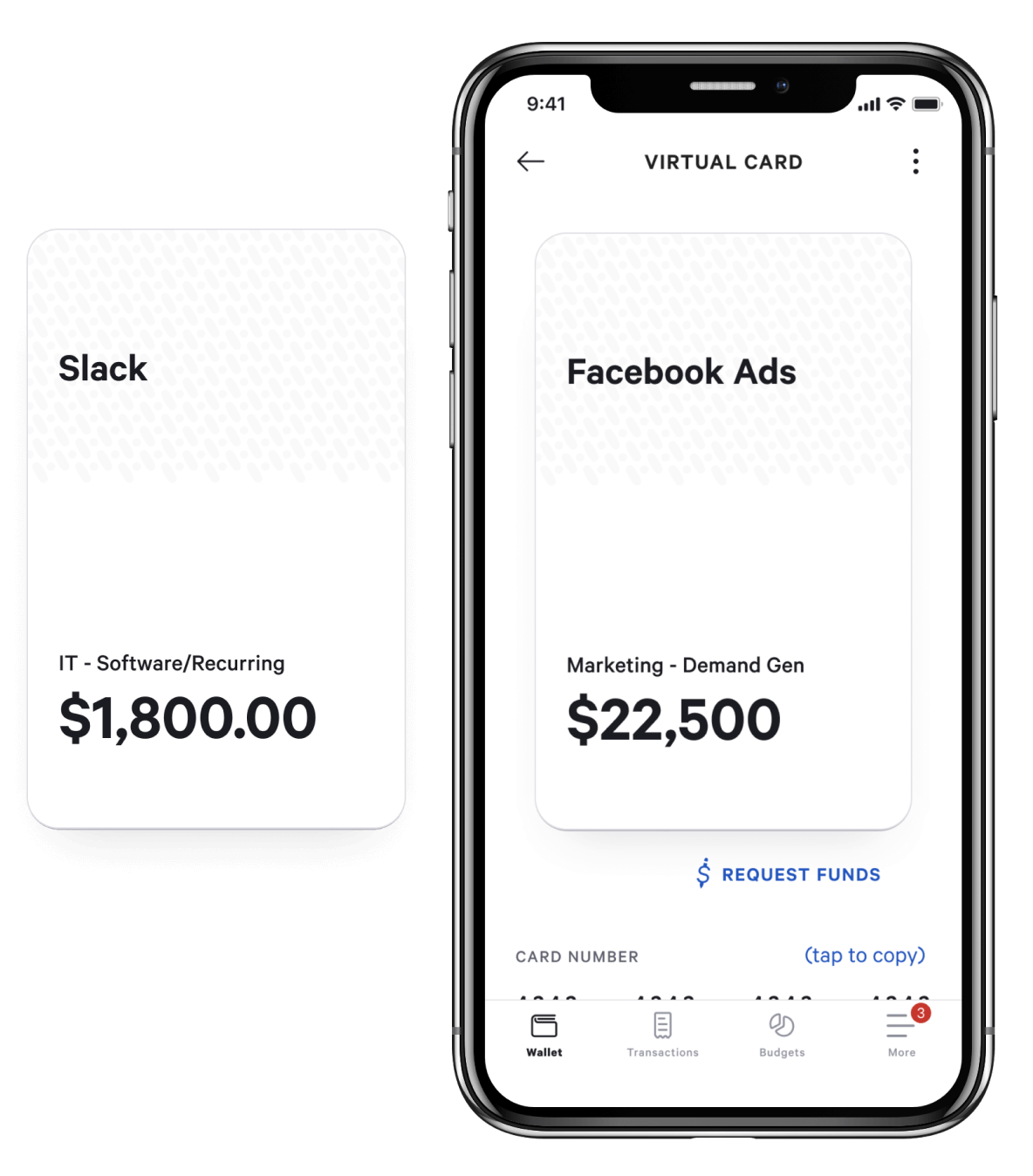

Recurring subscriptions are tedious to track and expose your entire credit line to many vendors. Virtual cards create a separate card for each subscription, set a limit on each card, and can be quickly frozen at any time. That’s fraud and overcharge protection in one amazing package.

Tracking your expenses across multiple systems is a time-consuming nightmare. Divvy shows all your spend in one place, increasing transaction visibility for spenders, budget owners, and leadership teams—immediately.

Expense management allows you to see and control every dollar, no matter where it’s spent or who swipes the card. Increased visibility into your expenses helps you make informed choices that fast track your business goals.

Expense management allows you to see and control every dollar, no matter where it’s spent or who swipes the card. Increased visibility into your expenses helps you make informed choices that fast track your business goals.

Expense management allows you to see and control every dollar, no matter where it’s spent or who swipes the card. Increased visibility into your expenses helps you make informed choices that fast track your business goals.

Expense management allows you to see and control every dollar, no matter where it’s spent or who swipes the card. Increased visibility into your expenses helps you make informed choices that fast track your business goals.

Submit the form and we’ll reach out shortly to help you get started.